Reverse mortgage calculator code#

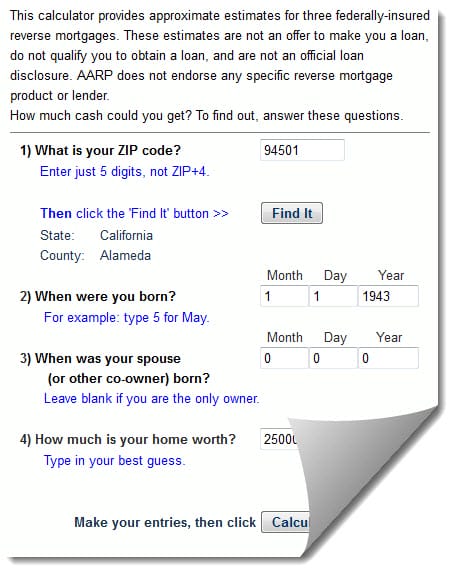

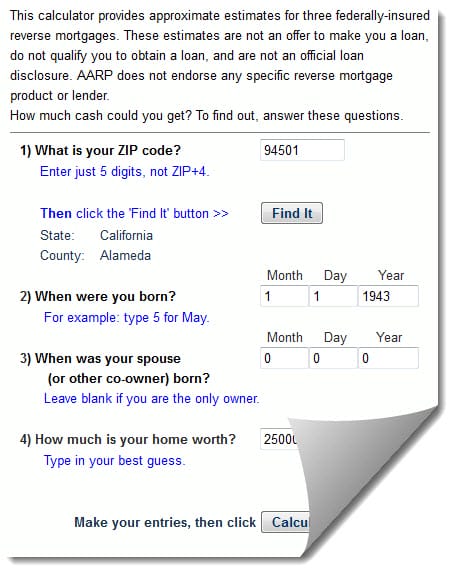

It must have the ability to retrieve and populate the local third-party costs (appraisal, title insurance, recording fees, etc.) based on the zip code you provide so that your proposal has the most accurate fees and costs possible. The calculator should be updated no less than daily and more often if needed.

If your spouse is younger than 62, they can qualify as an eligible non-borrowing spouse and remain in the home even if you leave or pass away, so long as they continue to meet all loan obligations.It should give you the information you are requesting and not withhold the loan option information, requiring you to either fill in your personal information (such as social security numbers and all your contact information including phone number) just so that you can get an idea of what is available to you.Īn effective calculator must allow you to see all options available and give you the opportunity to choose the option that best meets your needs. You must undergo a financial assessment to ensure you are able to meet the financial obligations of the loan, which includes the ability to pay your property taxes and homeowners insurance. You must complete reverse mortgage counseling with an independent counseling agency. Today, there are important safeguards in place to ensure that it can continue to help consumers for years to come. The HECM reverse mortgage product has been improved over the years so that it can better meet the needs of older adults. The home must be your primary residence. As a government-insured loan, there are several important requirements borrowers must meet to qualify. Traditional reverse mortgages were established in 1989 to help older homeowners age in place. Who Qualifies for a Reverse Mortgage Loan There are different types of reverse mortgages and the funds can be disbursed in a number of ways. If the loan balance exceeds the home’s value, the Federal Housing Administration will cover the difference. As a non-recourse loan, the borrower will never owe more than the house is worth.

If your spouse is younger than 62, they can qualify as an eligible non-borrowing spouse and remain in the home even if you leave or pass away, so long as they continue to meet all loan obligations.It should give you the information you are requesting and not withhold the loan option information, requiring you to either fill in your personal information (such as social security numbers and all your contact information including phone number) just so that you can get an idea of what is available to you.Īn effective calculator must allow you to see all options available and give you the opportunity to choose the option that best meets your needs. You must undergo a financial assessment to ensure you are able to meet the financial obligations of the loan, which includes the ability to pay your property taxes and homeowners insurance. You must complete reverse mortgage counseling with an independent counseling agency. Today, there are important safeguards in place to ensure that it can continue to help consumers for years to come. The HECM reverse mortgage product has been improved over the years so that it can better meet the needs of older adults. The home must be your primary residence. As a government-insured loan, there are several important requirements borrowers must meet to qualify. Traditional reverse mortgages were established in 1989 to help older homeowners age in place. Who Qualifies for a Reverse Mortgage Loan There are different types of reverse mortgages and the funds can be disbursed in a number of ways. If the loan balance exceeds the home’s value, the Federal Housing Administration will cover the difference. As a non-recourse loan, the borrower will never owe more than the house is worth.  The borrower must continue to pay property taxes and homeowner’s insurance, and must keep the house in good repair. The older you are, the more equity you’ll have access to. The amount you can borrow depends on your age, property value, and interest rate. The borrower remains the owner of the home and retains title.*. The loan is repaid when the last borrower or eligible non-borrowing spouse passes away or leaves the house. With a traditional reverse mortgage loan, borrowers can access their home equity without having to pay principal and interest.* It’s called a “reverse mortgage” because, unlike a traditional loan where the borrower makes payments to the lender, the lender makes payments to the borrower.

The borrower must continue to pay property taxes and homeowner’s insurance, and must keep the house in good repair. The older you are, the more equity you’ll have access to. The amount you can borrow depends on your age, property value, and interest rate. The borrower remains the owner of the home and retains title.*. The loan is repaid when the last borrower or eligible non-borrowing spouse passes away or leaves the house. With a traditional reverse mortgage loan, borrowers can access their home equity without having to pay principal and interest.* It’s called a “reverse mortgage” because, unlike a traditional loan where the borrower makes payments to the lender, the lender makes payments to the borrower.

0 kommentar(er)

0 kommentar(er)